Source: Shutterstock

Highlights

- ABNB’s Q1 sales and other operating income increased by 6.1% YoY to USD 2,272.0 million.

- The company recorded total cash and cash equivalents of USD 7,600.0 million for the period.

- Airbnb continues to focus on expanding core services, growing internationally with 27% YoY growth in Brazil

Airbnb, Inc. (NASDAQ: ABNB) is a global online marketplace connecting hosts and guests for short-term stays and experiences. The company offers tools and services to help hosts manage listings, pricing, and guest interactions.

In the first quarter of the financial year 2025 (Q1FY25), the company’s sales and other operating income increased by 6.1% YoY to USD 2,272.0 million, primarily driven by growth in nights stayed, partially offset by a slight decline in the average daily rate. Total cash and cash equivalents rose by 10.7% YoY to USD 7,600.0 million, supported by cash inflows from operating and financing activities, partially offset by outflows from investing activities. However, the net income declined by 41.7% YoY to USD 154.0 million, primarily due to higher expenses and lower interest income, which led to the net operating cash flow falling by 7.0% YoY.

Recent Business Update

On June 3, 2025, Airbnb disclosed a stockholder lawsuit filed by The Heritage Foundation and American Conservative Values ETF. The suit alleges the company improperly excluded proposals from its 2025 proxy. Airbnb disputes the claims but has agreed to consider the proposals for the 2026 meeting.

Company Outlook

Airbnb projects Q2 FY25 revenue between USD 2.99–3.05 billion, representing 9–11% YoY growth, supported by a 2% Easter timing benefit. The company expects the adjusted EBITDA margin to remain flat, slightly down due to increased marketing expenses for new product launches.

Airbnb continues to focus on expanding core services, growing internationally with 27% YoY growth in Brazil, and scaling new business initiatives as of June 9, 2025.

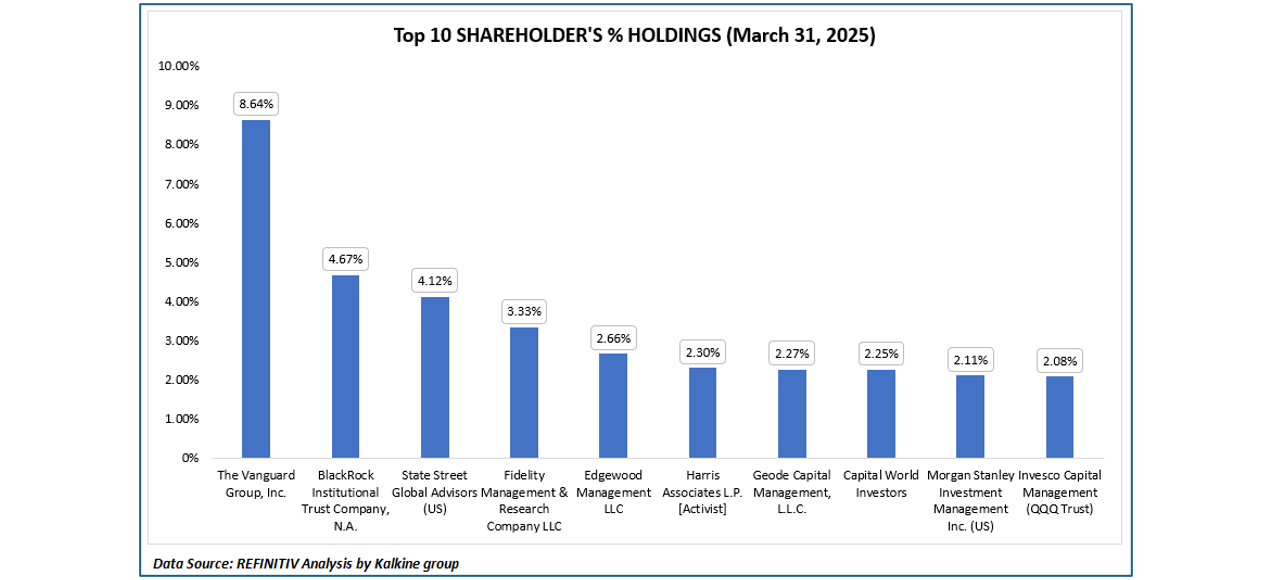

Top 10 Shareholders

The top 10 shareholders of Airbnb together form ~34.44% of the total shareholding in the company. The Vanguard Group, Inc. and BlackRock Institutional Trust Company, N.A. hold a maximum stake in the company at ~8.64% and ~4.67%, respectively.

Stock Information

The stock price of ABNB has surged by around 9.11% in the past three months, whereas it has fallen by about 0.54% in the past six months. The stock has a 52-week high and low of USD 99.88 to USD 163.93. As of June 11, 2025, the stock’s closing price is USD 138.06.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference data for all price data, currency, technical indicators, support, and resistance levels is June 11 2025. The reference data in this report has been partly sourced from REFINITIV.

Technical Indicators Defined

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Disclaimer:

StockNextt having Ontario Business Identification Number 1000958347 and British Columbia registration Number FM1051529 is a trade name under Kalkine Canada Advisory Services Inc., having Business Number 761925130BC0001. The information provided on https://stocknextt.com “Website” is general information only and it does not consider your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The Website is published by StockNextt a trade name under Kalkine Canada Advisory Services Inc. The link to our Terms and Conditions and Privacy Policy has been provided for your reference. On the date of publishing this article/report (mentioned on the website), employees and/or associates of StockNextt or Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the articles/ reports should not consider these stocks as advice or recommendations later.