Source: shutterstock

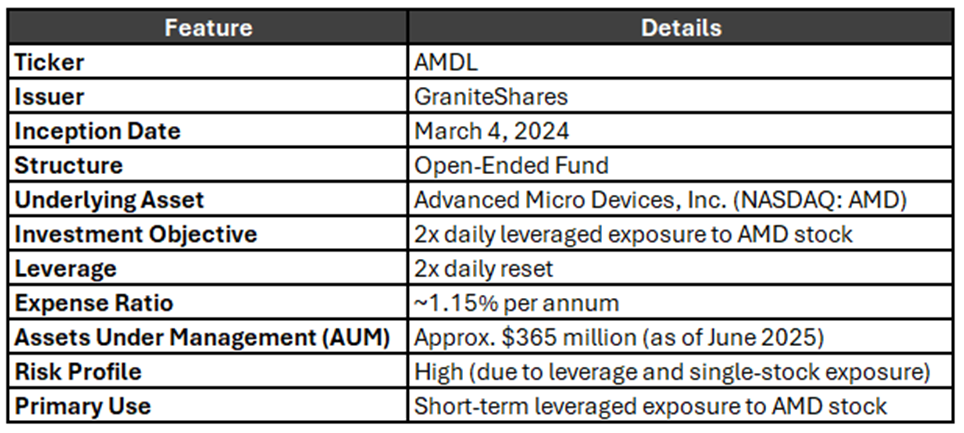

Summary Table

The GraniteShares 2x Long AMD Daily ETF (ticker: AMDL) is a leveraged exchange-traded fund designed to provide investors with twice the daily return of Advanced Micro Devices, Inc. (AMD) common stock. This article offers a neutral overview of AMDL’s design, underlying asset, risk-return profile, and suitability for different investors and traders.

Design and Underlying Asset: AMDL seeks daily investment results, before fees and expenses, equal to 200% of the daily percentage change in AMD’s stock price. AMD is a leading American semiconductor company known for its processors and graphics technologies. Unlike broad index ETFs, AMDL focuses solely on AMD stock, using leverage to amplify daily price movements.

The fund uses a simple, high-conviction strategy with daily rebalancing to maintain 2x leverage. This daily reset means returns over periods longer than one day may not equal twice the cumulative return of AMD due to compounding effects.

Risk and Return Characteristics: AMDL’s 2x leverage magnifies both gains and losses on a daily basis. For example, a 1% increase in AMD stock price in one day aims to translate into roughly a 2% gain for AMDL, and vice versa for declines.

Key risks include:

Historically, AMDL has experienced significant volatility, with a one-year NAV return around -76.7% and notable divergence from AMD’s benchmark returns during turbulent market periods.

Suitability for Traders and Investors: AMDL is primarily suited for investors with a bullish short-term outlook on AMD stock who understand leveraged ETFs and their risks. It is appropriate for:

AMDL is generally not recommended for long-term buy-and-hold investors due to leverage decay and volatility effects.

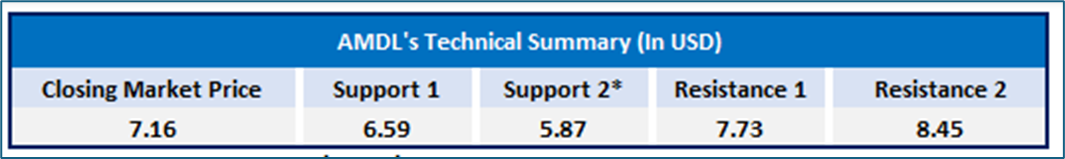

Technical Analysis: The GraniteShares 2x Long AMD Daily ETF (AMDL) is exhibiting strong bullish momentum, closing at $7.69 with a notable 7.33% daily gain, pushing above key resistance levels. The price has broken above the 20, 50, and 100-day EMAs, currently at $5.79, $6.15, and $6.38 respectively, and is now approaching the 200-day EMA at $8.28, which serves as the next significant resistance level. This move suggests a clear shift from a prolonged downtrend into a short- to medium-term uptrend. The RSI is in overbought territory at 72.23, signaling strong upward momentum, but also raising the possibility of a short-term pullback or consolidation. If AMDL can break and hold above the 200-day EMA, it could confirm a full trend reversal. However, traders should monitor closely for signs of exhaustion as the price nears this critical level. Overall, the technical setup points to a bullish bias, but some caution is warranted given the extended RSI.

Technical Table

*Closing Price as of June 23rd, 2025

Conclusion

In conclusion, AMDL is demonstrating strong bullish momentum and approaching a key resistance at the 200-day EMA, indicating the potential for a trend reversal. However, with the RSI in overbought territory and the risks associated with leveraged ETFs—such as volatility and compounding decay—traders should approach with caution. This ETF is best suited for short-term, active traders looking to capitalize on AMD’s near-term strength rather than long-term investors.

Disclaimer:

StockNextt having Ontario Business Identification Number 1000958347 and British Columbia registration Number FM1051529 is a trade name under Kalkine Canada Advisory Services Inc., having Business Number 761925130BC0001. The information provided on https://stocknextt.com “Website” is general information only and it does not consider your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The Website is published by StockNextt a trade name under Kalkine Canada Advisory Services Inc. The link to our Terms and Conditions and Privacy Policy has been provided for your reference. On the date of publishing this article/report (mentioned on the website), employees and/or associates of StockNextt or Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the articles/ reports should not consider these stocks as advice or recommendations later.