Source: shutterstock

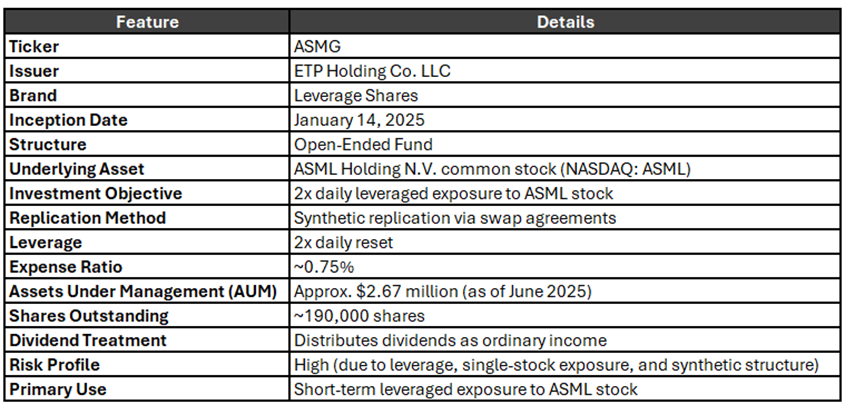

Summary Table

The Leverage Shares 2X Long ASML Daily ETF (ticker: ASMG) is a leveraged exchange-traded fund designed to provide investors with twice the daily performance of ASML Holding N.V.’s publicly traded common stock. This article offers a neutral overview of ASMG’s design, underlying asset, risk-return profile, and the type of investors and traders who may consider this fund.

Design and Underlying Asset: ASMG seeks to deliver daily investment results, before fees and expenses, that correspond to 200% of the daily performance of ASML Holding N.V. (NASDAQ: ASML), a leading semiconductor equipment manufacturer. Unlike ETFs that track an index, ASMG focuses on a single underlying security — the ASML stock itself.

The fund achieves its leveraged exposure primarily through swap agreements and synthetic replication. It rebalances its exposure daily to maintain the 2x leverage target, adjusting for ASML’s price movements each trading day. This daily reset means that the fund’s returns over periods longer than one day can differ significantly from twice the cumulative return of ASML stock due to the effects of compounding and market volatility.

ASMG is structured as an open-ended fund and trades on an exchange like a typical stock. It offers investors capped losses limited to their invested amount, without the risk of margin calls typically associated with direct leverage.

Risk and Return Characteristics: As a 2x leveraged ETF focused on a single stock, ASMG carries a high-risk profile. Its objective to magnify ASML’s daily price movements means that gains and losses are amplified on a daily basis. For example, a 1% daily increase in ASML’s stock price would aim to result in a 2% gain in ASMG, while a 1% decline would translate to a 2% loss.

Key risks include:

Because of these risks, ASMG is intended as a short-term tactical investment tool rather than a long-term buy-and-hold vehicle. The fund may lose money over time even if ASML’s stock price rises, especially in volatile or sideways markets.

Suitability for Traders and Investors: ASMG is designed for investors who want leveraged exposure to ASML stock’s daily price movements and who understand the complexities and risks of leveraged ETFs. It may be appropriate for:

ASMG is generally not suitable for long-term investors or those seeking stable, steady returns due to the effects of leverage decay and compounding.

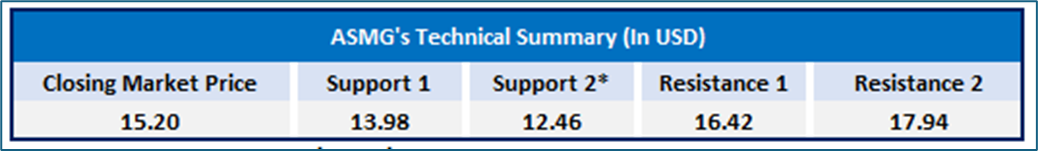

Technical Analysis

Source: TradingView.com, Analysis by StockNextt.

The Leverage Shares 2X Long ASML Daily ETF (ASMG) is showing bullish momentum, with the price closing at $15.20 after a strong 6.44% gain, trading above its 20, 50, and 100-day EMAs, which are all positively aligned—a technically favorable sign. The ETF is approaching a key resistance level near $15.47, and a breakout above this could signal further upside. The RSI at 59.83 reflects strengthening momentum without being overbought, suggesting room for continued gains. Support is well-defined in the $13.80–14.00 range, and as long as the price holds above these moving averages, the near-term outlook remains constructive.

Technical Table

Conclusion

The Leverage Shares 2X Long ASML Daily ETF (ASMG) offers investors a way to gain twice the daily exposure to ASML Holding’s stock price through a leveraged, synthetic structure. Its design aims to magnify daily returns but carries significant risks including leverage decay, compounding effects, and counterparty risk.

ASMG is best suited for experienced, short-term traders or investors with a strong conviction in ASML’s daily price movements who can actively monitor their holdings. It is not intended for long-term investment due to the potential for significant divergence from expected returns over time.

Investors should carefully consider their risk tolerance and investment horizon before engaging with this leveraged single-stock ETF.

Disclaimer:

StockNextt having Ontario Business Identification Number 1000958347 and British Columbia registration Number FM1051529 is a trade name under Kalkine Canada Advisory Services Inc., having Business Number 761925130BC0001. The information provided on https://stocknextt.com “Website” is general information only and it does not consider your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The Website is published by StockNextt a trade name under Kalkine Canada Advisory Services Inc. The link to our Terms and Conditions and Privacy Policy has been provided for your reference. On the date of publishing this article/report (mentioned on the website), employees and/or associates of StockNextt or Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the articles/ reports should not consider these stocks as advice or recommendations later.