Source: shutterstock

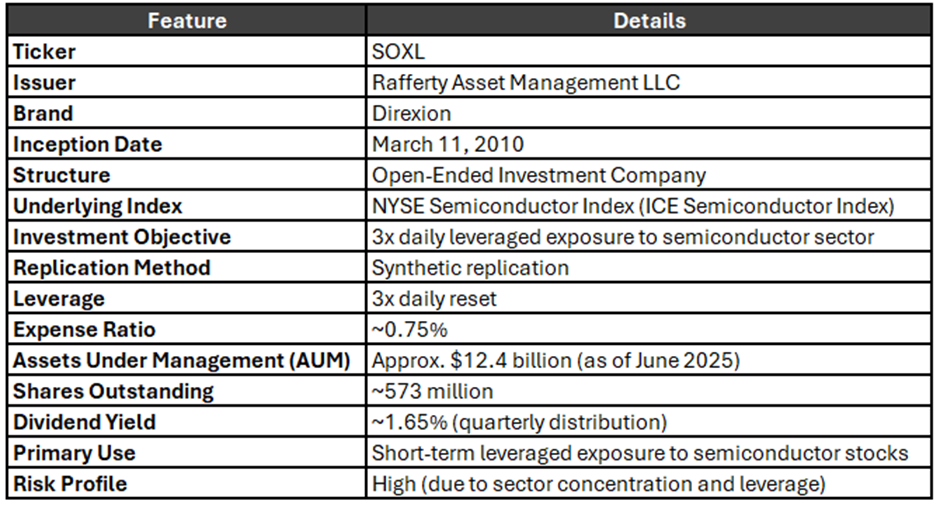

Summary Table

The Direxion Daily Semiconductor Bull 3X Shares ETF (ticker: SOXL) is a leveraged exchange-traded fund designed to provide investors with three times the daily performance of the semiconductor sector in the U.S. equity market. This article provides a neutral overview of SOXL’s design, underlying index, risk-return profile, and the type of investors and traders who might consider using this fund.

Design and Underlying Index: SOXL seeks daily investment results, before fees and expenses, that correspond to 300% of the daily performance of the NYSE Semiconductor Index (also known as the ICE Semiconductor Index). This index tracks the performance of the 30 largest U.S.-listed semiconductor companies, including manufacturers and providers of semiconductor equipment and services. The index is market-cap weighted with specific caps on the largest holdings to maintain diversification, including a cap of 8% on the top five securities and 4% on others, as well as a 10% cap on American Depositary Receipts (ADRs).

The ETF achieves its exposure through a combination of financial instruments, including swap agreements, securities of the index, and ETFs that track the index. SOXL uses synthetic replication and rebalances its 3x leverage daily, which means it aims to deliver triple the daily return of the underlying index but not necessarily three times the cumulative return over longer periods due to compounding effects.

SOXL was launched on March 11, 2010, and is managed by Rafferty Asset Management, LLC, under the Direxion brand. The fund is structured as an open-ended investment company domiciled in the United States.

Risk and Return Characteristics: As a 3x leveraged ETF, SOXL amplifies the daily movements of the semiconductor sector by a factor of three. This leverage magnifies both gains and losses, making the fund highly volatile and risky, especially over periods longer than one trading day.

Key risks include:

Historically, SOXL has exhibited high volatility consistent with its leveraged exposure. For example, it experienced significant drawdowns during semiconductor sector downturns but also substantial gains during sector rallies.

Suitability for Traders and Investors: SOXL is primarily designed for investors and traders with a bullish short-term outlook on the semiconductor sector who seek magnified exposure to daily price movements. Its characteristics make it more appropriate for:

SOXL is generally not suitable for long-term buy-and-hold investors due to the effects of leverage decay and compounding, which can erode returns over time in volatile markets.

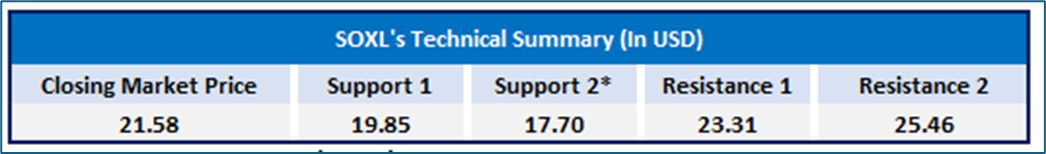

Technical Analysis

Source: TradingView.com, Analysis by StockNexTT.

SOXL is currently exhibiting a short-term bullish trend, with price action supported by a series of higher lows and closes above the 20, 50, and 100-day EMAs. The ETF recently closed at $21.58, showing upward momentum, though it faces strong resistance near the $24.11 level, marked by the 200-day EMA—a key long-term trend indicator. The RSI stands at 62.93, suggesting bullish momentum but approaching overbought territory, which could lead to a short-term pullback. The convergence of the 50-day and 100-day EMAs around $19.79 offers a key support zone, while a breakout above the $24 region could confirm a stronger trend reversal. Until then, the price remains in a recovery phase, with caution warranted near resistance.

Technical Table

Conclusion

The Direxion Daily Semiconductor Bull 3X Shares ETF (SOXL) offers investors a way to gain triple the daily exposure to the semiconductor sector’s performance. Its design, based on the NYSE Semiconductor Index, uses synthetic replication and daily leverage rebalancing to achieve its investment objective.

While SOXL can provide amplified returns during strong sector rallies, it carries significant risks related to leverage, daily reset effects, and sector concentration. These factors make it suitable primarily for short-term traders and experienced investors with a bullish view on semiconductors who can actively monitor their positions.

Due to the complexities and risks involved in SOXL investors should carefully consider their risk tolerance and investment horizon before engaging with this leveraged sector ETF.

Disclaimer:

StockNextt having Ontario Business Identification Number 1000958347 and British Columbia registration Number FM1051529 is a trade name under Kalkine Canada Advisory Services Inc., having Business Number 761925130BC0001. The information provided on https://stocknextt.com “Website” is general information only and it does not consider your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The Website is published by StockNextt a trade name under Kalkine Canada Advisory Services Inc. The link to our Terms and Conditions and Privacy Policy has been provided for your reference. On the date of publishing this article/report (mentioned on the website), employees and/or associates of StockNextt or Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the articles/ reports should not consider these stocks as advice or recommendations later.