Source: Shutterstock

Highlights

- ASML’s Q1FY25 net revenue increased by 46.3% YoY to EUR 7,741.5 million, driven by higher sales across systems and services

- Net income surged 92.4% YoY to EUR 2,355.0 million in Q1FY25, despite rising costs

- ASML repurchased 85,289 shares in April 2025, totaling EUR 49.13 million as part of its ongoing buyback program

- The company projects 2025 net sales between EUR 30 billion and EUR 35 billion, with a gross margin of 51%-53%

- For Q2 2025, ASML forecasts net sales of EUR 7.2 billion to EUR 7.7 billion, with R&D costs of EUR 1.2 billion

ASML Holding N.V. (NASDAQ:ASML) is a Netherlands-based holding company that operates globally through subsidiaries in regions including the U.S., Asia, and Europe. It functions through a single business segment focused on the development, production, marketing, and servicing of advanced semiconductor equipment systems, including lithography, metrology, and inspection technologies essential for chip manufacturing.

In the first quarter of the financial year 2025 (Q1FY25), ASML reported total net revenue of EUR 7,741.5 million, a 46.3% increase compared to Q1FY24, driven by higher revenue from both the net system sales and net service and field option sales segments.

Net income rose by 92.4% YoY, reaching EUR 2,355.0 million in Q1FY25, largely due to increased revenue, although partially offset by higher costs. Cash from operating activities improved to EUR (58.6) million from EUR (251.9) million, benefiting from higher net income but impacted by unfavourable changes in net working capital.

Total cash and cash equivalents decreased by 28.6% YoY to EUR 9,098.4 million due to cash outflows across operating, investing, and financing activities.

Recent Business Update

ASML Holding repurchased 85,289 shares between April 22 and April 25, 2025, as part of its ongoing share buyback program announced on November 10, 2022. The repurchase, valued at approximately EUR 49.13 million, occurred at prices ranging from EUR 556.64 to EUR 586.57 per share. This update, in line with the Market Abuse Regulation, reflects ASML’s continued focus on enhancing shareholder value, following its EUR 2.7 billion buyback in Q1 2025.

Company Outlook

ASML projects total net sales for 2025 to be between EUR 30 billion and EUR 35 billion. The expected gross margin is 51% to 53%. However, CEO Christophe Fouquet highlighted increased uncertainty due to recent tariff announcements affecting the macro environment.

For Q2 2025, ASML anticipates net sales of EUR 7.2 billion to EUR 7.7 billion, with a gross margin of 50% to 53%. This range reflects tariff-related uncertainties. The company also expects EUR 1.2 billion in R&D costs and EUR 300 million in SG&A expenses.

While ASML expects growth driven by AI demand, market dynamics pose both opportunities and risks. Some customers will benefit more than others from the AI shift, impacting the revenue outlook.

Stock Information

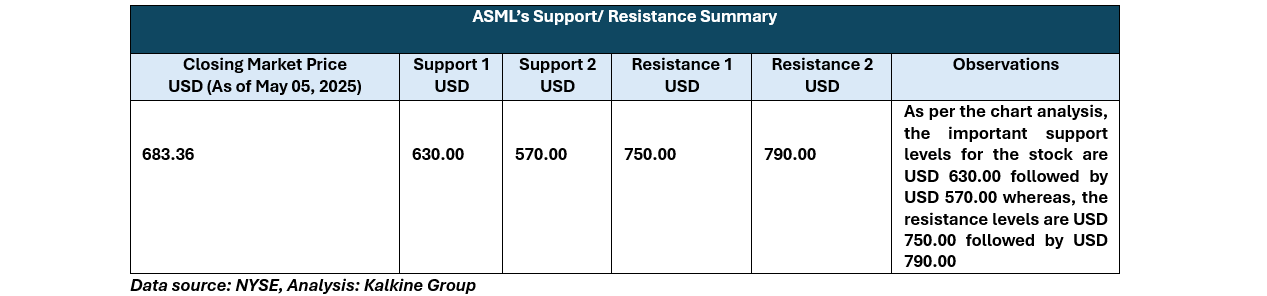

ASML's stock price has risen approximately 12.82% over the past month; however, it has declined by about 16.71% over the past nine months. The stock's 52-week trading range spans from USD 578.51 to USD 1,110.09. As of May 5, 2025, the stock closed at USD 683.36.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference data for all price data, currency, technical indicators, support, and resistance levels is May 05, 2025. The reference data in this report has been partly sourced from REFINITIV.

Technical Indicators Defined

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Disclaimer:

StockNextt having Ontario Business Identification Number 1000958347 and British Columbia registration Number FM1051529 is a trade name under Kalkine Canada Advisory Services Inc., having Business Number 761925130BC0001. The information provided on https://stocknextt.com “Website” is general information only and it does not consider your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The Website is published by StockNextt a trade name under Kalkine Canada Advisory Services Inc. The link to our Terms and Conditions and Privacy Policy has been provided for your reference. On the date of publishing this article/report (mentioned on the website), employees and/or associates of StockNextt or Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the articles/ reports should not consider these stocks as advice or recommendations later.