Highlights

- Cameco's Q4 2024 revenue surged 40.2% YoY, reaching CAD 1,183.0 million

- Gross profit for Q4 2024 increased by 88.0% YoY, reaching CAD 250.0 million

- Adjusted EBITDA for Q4 2024 grew by 56.0% YoY, totalling CAD 524.0 million

- Net earnings attributable to equity holders rose 68.8% YoY, reaching CAD 135.0 million in Q4 2024

- The company expects a revenue CAGR of 6% to 8%, driven by high demand for various reactor fuels and services

Cameco Corporation (TSX CCO) is one of the global suppliers of uranium fuel essential for powering a clean-energy future. The company’s uranium assets are geographically diverse, featuring a substantial portfolio of low-cost mining operations, extensive mineral reserves and resources, along exploration and development projects.

In the fourth quarter of 2024 (Q4 2024), the company reported a significant increase in revenue, reaching CAD 1,183.0 million, compared to CAD 844.0 million in Q4 2023, marking a 40.2% year-over-year (YoY) growth. This increase was primarily driven by higher uranium sales volumes and elevated realized prices. Gross profit for the quarter also saw a notable increase of 88.0% to CAD 250.0 million from CAD 133.0 million in Q4 2023, as the company effectively controlled its cost of sales while benefiting from the higher revenue.

Adjusted EBITDA grew by 56.0% YoY in Q4 2024, reaching CAD 524.0 million, up from CAD 336.0 million in the same period last year. This growth was largely attributed to the boost in revenue. Furthermore, net earnings attributable to equity holders increased by 68.8% YoY, totalling CAD 135.0 million in Q4 2024, compared to CAD 80.0 million in Q4 2023. This rise in net earnings was driven by the revenue performance and a higher income from operations.

Recent Business Update

On January 27, 2025, Cameco Corporation announced that its partner, National Atomic Company Kazatomprom JSC (Kazatomprom), and Joint Venture Inkai LLP (JV Inkai) have resumed production at the Inkai operation. Cameco and Kazatomprom are now working together with JV Inkai to evaluate the effects of the production suspension on the operation's production plans for 2025. Kazatomprom holds a 60% stake in JV Inkai, while Cameco owns a 40% interest.

Company Outlook

The company anticipates a compound annual growth rate (CAGR) of 6% to 8% in revenue from its core operations, which is slightly higher than the average growth rate of the nuclear industry. Projected margins for the core business are expected to align with historical figures, ranging from 16% to 19%. However, fluctuations may occur due to shifts in the product mix compared to prior years.

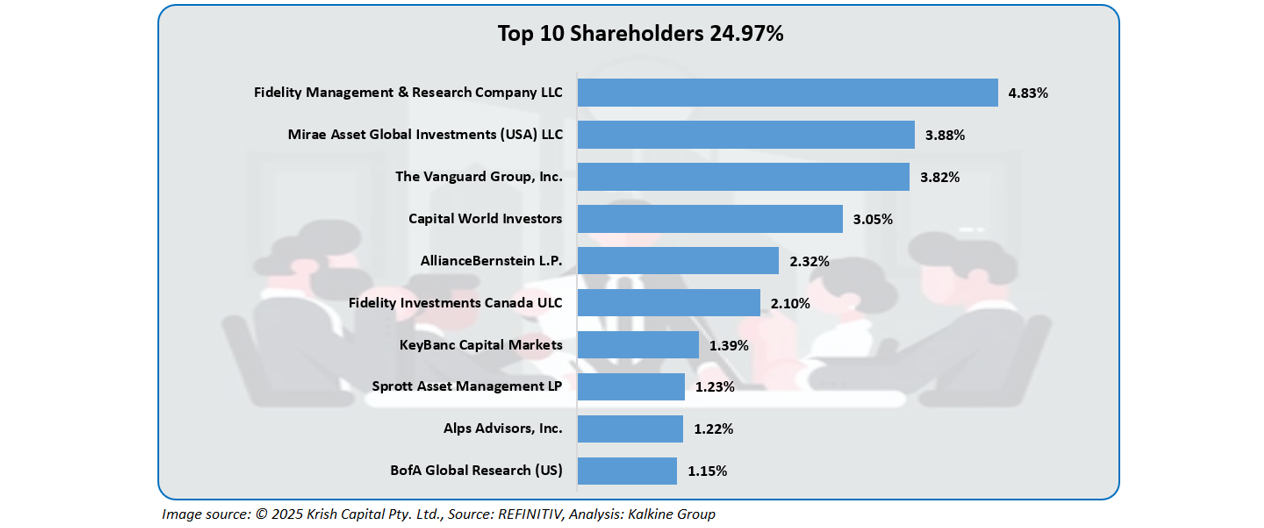

Top 10 Shareholders

The top 10 shareholders of Cameco Corporation collectively own about 24.97% of the company’s total shares. Fidelity Management & Research Company LLC holds the largest stake at approximately 4.83%, followed by Mirae Asset Global Investments (USA) LLC with around 3.88%.

Stock Information

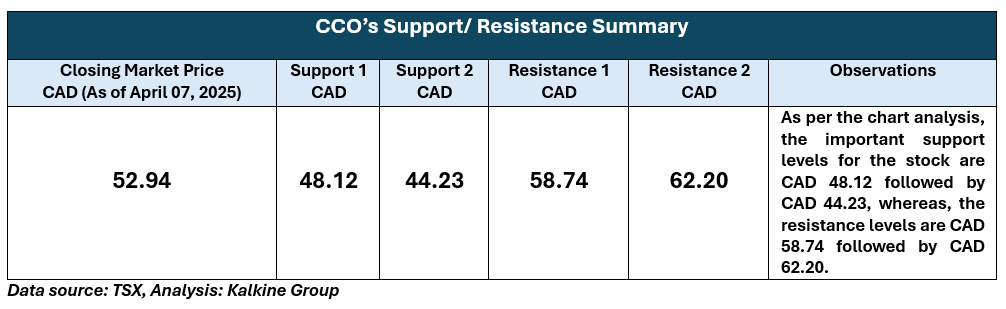

The stock has experienced a decline of approximately 10.63% over the past week and 12.01% over the past month. Additionally, it is currently trading below its 52-week high of CAD 88.18 and its 52-week low of CAD 48.71. As of April 7, 2025, the stock's closing price stands at CAD 52.94.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference data for all price data, currency, technical indicators, support, and resistance levels is April 07, 2025. The reference data in this report has been partly sourced from REFINITIV.

Technical Indicators Defined

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Disclaimer:

StockNextt having Ontario Business Identification Number 1000958347 and British Columbia registration Number FM1051529 is a trade name under Kalkine Canada Advisory Services Inc., having Business Number 761925130BC0001. The information provided on https://stocknextt.com “Website” is general information only and it does not consider your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The Website is published by StockNextt a trade name under Kalkine Canada Advisory Services Inc. The link to our Terms and Conditions and Privacy Policy has been provided for your reference. On the date of publishing this article/report (mentioned on the website), employees and/or associates of StockNextt or Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the articles/ reports should not consider these stocks as advice or recommendations later.