Source: Shutterstock

Highlights

Great-West Lifeco Inc. (TSX: GWO) is one of Canada’s top three life insurance companies, with operations spanning Canada, the United States, and Europe. It offers individual and group insurance in Canada, manages Empower Retirement and Putnam Investments in the United States, and provides life insurance and reinsurance across the United Kingdom, Ireland, and Germany.

In the first quarter of the financial year 2025 (Q1FY25), the company’s base earnings increased by 5.3% YoY to CAD 1,030.0 million, primarily driven by performance in the retirement and wealth business, improved operating efficiency, and favourable equity market conditions. Free and spread income rose by 11.5% YoY to CAD 1,391.0 million, supported by higher client asset balances, net flows, and continued growth in the U.S. segment, particularly within Empower’s retirement platform. However, net earnings from contributing operations declined by 16.6% YoY, mainly due to unfavourable market experience, lower returns on real estate assets, and one-time impacts such as wildfire claims and mortgage loan write-downs. Insurance contract assets declined by 0.5% YoY to CAD 1,275.0 million, from CAD 1,282.0 million in Q1FY24.

Business Update

The company’s Great-West Lifeco’s U.S. retirement division has launched a new program enabling 19 million plan participants to access private equity, credit, and real estate investments through Collective Investment Trusts (CITs), in partnership with Apollo, PIMCO, and Franklin Templeton.

The company also declared a quarterly dividend of CAD 0.61 per share, payable on June 30, 2025, to shareholders of record as of June 2, 2025.

Company Outlook

As per the company, it is well-positioned for continued growth in FY2025, supported by U.S. Wealth and Retirement momentum, disciplined execution, and a healthy financial foundation including a 130% LICAT ratio, CAD 2.5 billion in cash, and diversified operations despite potential short-term pressures from market volatility and interest rate sensitivity.

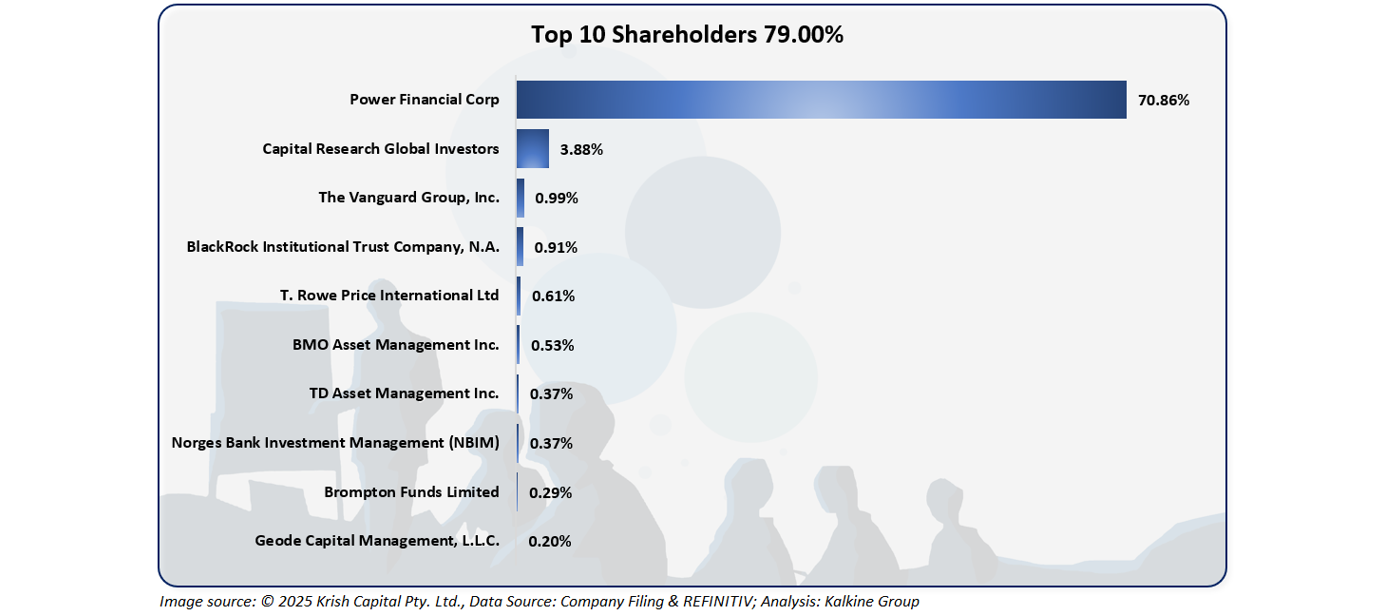

Top 10 shareholders

The top 10 shareholders of GWO collectively hold around ~79.00% of the company’s total shares, with the largest stakes held by Power Financial Corp at approximately 70.86% and Capital Research Global Investors at about ~3.88%.

Stock Information

The stock price of GWO has declined by roughly 1.43% over the past week and gained about 5.67% in the last six months, while currently trading below the average of its 52-week high of CAD 57.61 and 52-week low of CAD 38.44. As of June 17, 2025, the stock’s closing price stands at CAD 50.06.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference data for all price data, currency, technical indicators, support, and resistance levels is 17 June 2025. The reference data in this report has been partly sourced from REFINITIV.

Technical Indicators Defined

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Disclaimer:

StockNextt having Ontario Business Identification Number 1000958347 and British Columbia registration Number FM1051529 is a trade name under Kalkine Canada Advisory Services Inc., having Business Number 761925130BC0001. The information provided on https://stocknextt.com “Website” is general information only and it does not consider your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The Website is published by StockNextt a trade name under Kalkine Canada Advisory Services Inc. The link to our Terms and Conditions and Privacy Policy has been provided for your reference. On the date of publishing this article/report (mentioned on the website), employees and/or associates of StockNextt or Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the articles/ reports should not consider these stocks as advice or recommendations later.