Source: Shutterstock

Highlights

- Keyera Corp’s FY24 revenue increased by 1.2% YoY, reaching CAD 7,138.4 million

- Net earnings rose by 14.8% YoY in FY24, driven by reduced impairment expenses and asset disposals

- The company targets 7-8% annual growth in fee-based adjusted EBITDA for 2024-2027

Keyera Corp. (TSX:KEY) is a midstream energy company based in Alberta, Canada. It gathers and processes natural gas across western Canada. The company also stores, transports, and blends NGLs and crude oil. It markets NGLs, iso-octane, and crude. Keyera operates over 4,000 km of pipelines and several gas plants.

In the financial year 2024 (FY24), the company posted a modest 1.2% YoY increase in revenue, reaching CAD 7,138.4 million, supported by solid contributions from all three business segments. However, the operating margin declined by 3.3% YoY to CAD 1,385.6 million, primarily due to an unrealized non-cash loss of CAD 69 million from risk management contracts in the Marketing segment.

Net earnings rose by 14.8% YoY to CAD 486.6 million in FY24, driven by reduced impairment expenses and a net gain on asset disposals. Meanwhile, distributable cash flow declined by 9.8% YoY to CAD 770.9 million, mainly due to higher cash tax payments.

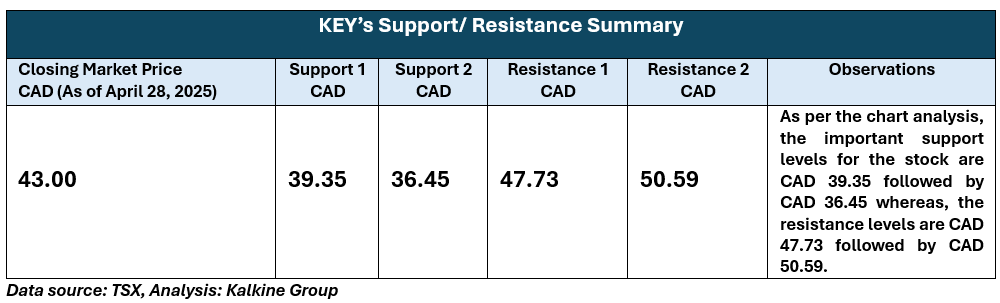

At the last closing price of CAD 43.00 as of April 28, 2025, the stock offered a dividend yield of approximately 4.88%.

Recent Business Update

As of February 13, 2025, the company reported a decent financial position, ending the year with a net debt to adjusted EBITDA ratio of 2.0 times, well below its target range of 2.5 to 3.0 times. This balance sheet positions the company to pursue equity self-funded growth opportunities.

Company Outlook

The company provided higher guidance, targeting a 7-8% annual growth in fee-based adjusted EBITDA for the 2024-2027 period. Following the conclusion of the NGL contracting season, the Marketing segment's 2025 realized margin is expected to range between CAD 310 million and CAD 350 million.

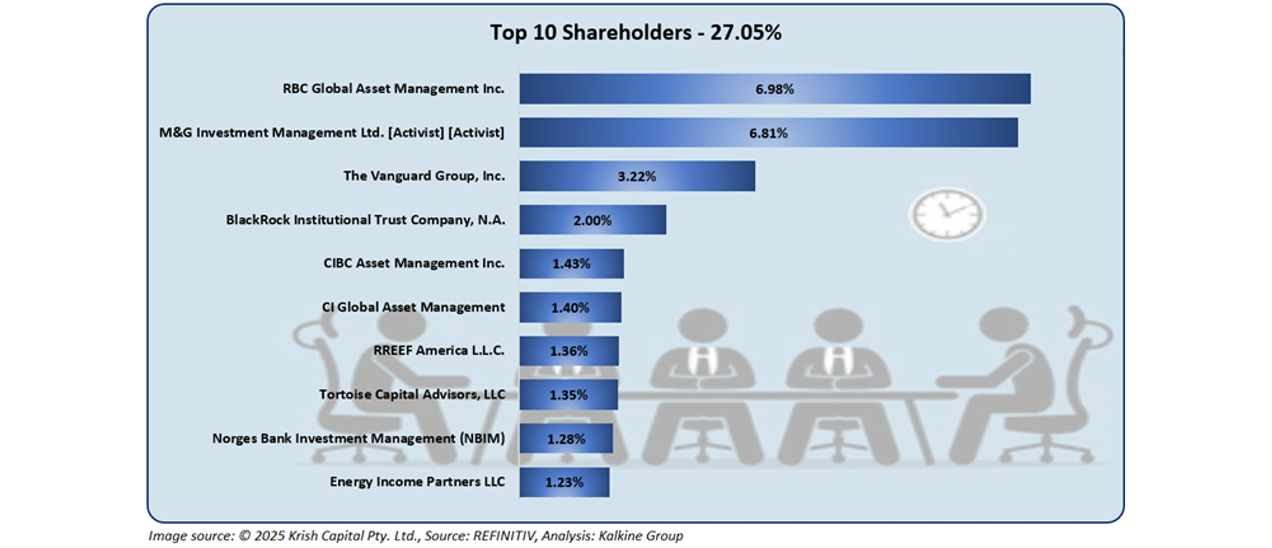

Top 10 Shareholders

The top 10 shareholders of KEY collectively own approximately 27.05% of the total shares. RBC Global Asset Management Inc. and M&G Investment Management Ltd. hold the largest stakes in the company, with approximately 6.98% and 6.81%, respectively.

Stock Information

The stock has gained around 3.44% over the past week. However, it has decreased by approximately 3.32% in the past month. Currently, the stock is trading above its 52-week high of CAD 47.90 and 52-week low of CAD 34.38. As of April 28, 2025, the stock closed at CAD 43.00.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference data for all price data, currency, technical indicators, support, and resistance levels is April 28 2025. The reference data in this report has been partly sourced from REFINITIV.

Technical Indicators Defined

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Disclaimer:

StockNextt having Ontario Business Identification Number 1000958347 and British Columbia registration Number FM1051529 is a trade name under Kalkine Canada Advisory Services Inc., having Business Number 761925130BC0001. The information provided on https://stocknextt.com “Website” is general information only and it does not consider your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The Website is published by StockNextt a trade name under Kalkine Canada Advisory Services Inc. The link to our Terms and Conditions and Privacy Policy has been provided for your reference. On the date of publishing this article/report (mentioned on the website), employees and/or associates of StockNextt or Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the articles/ reports should not consider these stocks as advice or recommendations later.