Source: Shutterstock

Moleculin Biotech, Inc. (NASDAQ: MBRX) is a Phase III clinical-stage pharmaceutical company advancing a pipeline of therapeutic candidates addressing tumors and viruses. The Company is conducting a pivotal Phase III trial evaluating Annamycin, a non-cardiotoxic anthracycline, in combination with Cytarabine for the treatment of subjects with relapsed/refractory acute myeloid leukemia (AML). It has three core technologies and six drug candidates, three of which have shown human activity in clinical trials.

Financial Performance

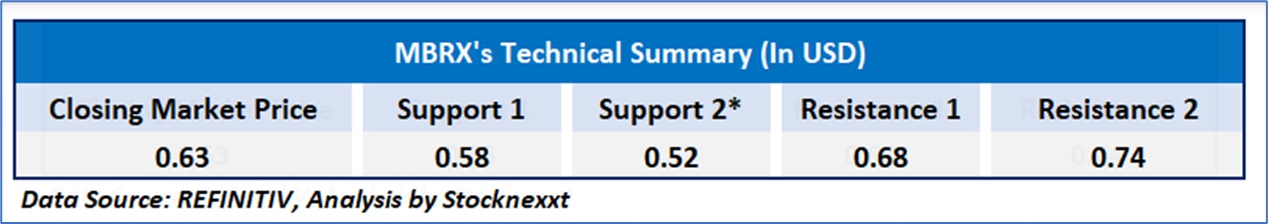

Technical Summary

On the technical front, Moleculin Biotech, Inc.'s (Nasdaq: MBRX) stock has endured a sustained downtrend since late 2024, characterized by elevated volatility and speculative activity. The daily price chart indicates stock trading below its 50-day and 200-day simple moving averages, presently at USD0.75 and USD1.55 respectively, reflecting persistent bearish momentum. The relative strength index (RSI) is upward trending at 59.29, suggesting a phase of recovery following significant declines, with potential support around the USD0.40-USD 0.45 mark, though resistance persists near the moving average levels and prior peaks.

In conclusion, Moleculin Biotech, Inc. (Nasdaq: MBRX) finds itself at a pivotal moment. While the company’s promising pipeline, including the Phase 3 MIRACLE trial for Annamycin, offers significant potential within the oncology therapeutic landscape, financial constraints and market uncertainties present hurdles to short-term performance. Investors will keenly observe indications of clinical progress and market dynamics that could spur a reversal in the stock’s technical trajectory.

Disclaimer:

StockNextt having Ontario Business Identification Number 1000958347 and British Columbia registration Number FM1051529 is a trade name under Kalkine Canada Advisory Services Inc., having Business Number 761925130BC0001. The information provided on https://stocknextt.com “Website” is general information only and it does not consider your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The Website is published by StockNextt a trade name under Kalkine Canada Advisory Services Inc. The link to our Terms and Conditions and Privacy Policy has been provided for your reference. On the date of publishing this article/report (mentioned on the website), employees and/or associates of StockNextt or Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the articles/ reports should not consider these stocks as advice or recommendations later.