Source: Shutterstock

Nuvve Holding Corp., a key player in the vehicle-to-grid (V2G) technology sector, continues to navigate the complexities of scaling its innovative energy solutions amid a challenging financial landscape. The San Diego-based company reported trailing twelve months revenue of approximately $5.44 million as of early 2025, reflecting steady growth in a market that remains in its infancy. However, Nuvve’s commitment to research, development, and expansion has resulted in ongoing net losses, a common scenario for emerging clean technology firms investing heavily in future market capture.

Financial Performance

Despite modest revenue figures, Nuvve’s financial health underscores the capital-intensive nature of the V2G industry. The company’s operating expenses continue to outpace its top line, driven by investments in technology and strategic partnerships across North America and Europe. This dynamic has led to negative operating margins, highlighting the company’s focus on long-term innovation over short-term profitability. Its balance sheet likely reflects limited cash reserves and a dependence on equity financing, raising concerns about potential shareholder dilution if additional capital raises become necessary.

The company’s prospects are buoyed by several favorable trends. Global adoption of electric vehicles is accelerating, expanding the addressable market for Nuvve’s V2G platform. Government incentives and tightening emissions regulations across the U.S., Europe, and Asia further support the company’s growth trajectory. Strategic partnerships with utilities, automakers, and infrastructure providers have positioned Nuvve to scale operations more quickly and penetrate new markets. As an early innovator, Nuvve also benefits from intellectual property advantages and brand recognition in a nascent sector.

However, risks remain significant. The company’s ongoing cash burn presents financial challenges, with the possibility of future equity dilution. Market adoption of V2G technology is still uncertain, influenced by consumer preferences, regulatory developments, and competition from alternative energy solutions. Larger, better-capitalized competitors could enter the space, intensifying pressure on Nuvve’s market share. Additionally, the company faces execution risks as it attempts to scale operations while maintaining technological leadership and controlling costs.

Technical Summary

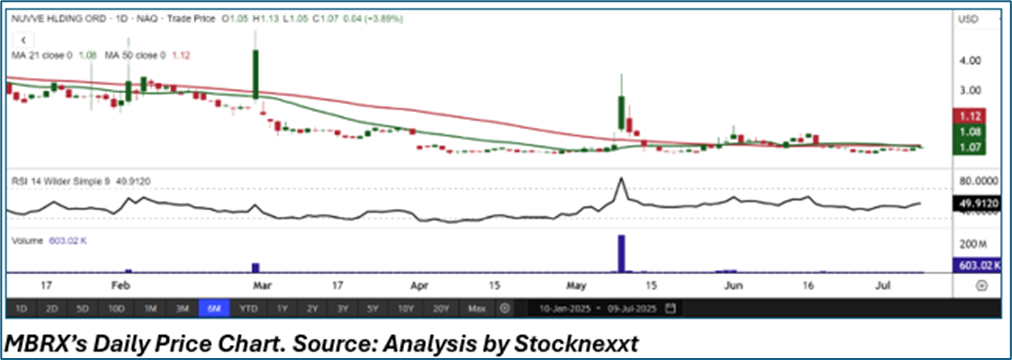

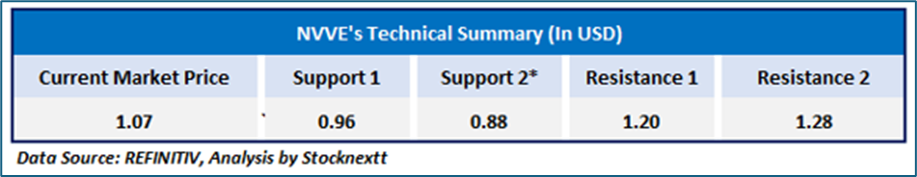

On the technical front, Nuvve’s stock has experienced a prolonged downtrend since late 2024, marked by high volatility and speculative trading. The daily price chart shows the stock trading below its 50-day and 63-day simple moving averages, currently at $1.08 and $1.11 respectively, signaling bearish momentum. The relative strength index (RSI) hovers near the neutral 50 mark, indicating a period of consolidation after steep declines. Price action suggests some support around the $1.00 level, but resistance remains at moving average levels and previous highs.

Technical Table

In conclusion, Nuvve Holding Corp. stands at a critical juncture. While the company’s innovative V2G technology positions it well within the rapidly evolving clean energy ecosystem, financial and market risks pose challenges to near-term performance. Investors will be closely watching for signs of fundamental improvement and broader market shifts that could catalyze a turnaround in the stock’s technical outlook.

Disclaimer:

StockNextt having Ontario Business Identification Number 1000958347 and British Columbia registration Number FM1051529 is a trade name under Kalkine Canada Advisory Services Inc., having Business Number 761925130BC0001. The information provided on https://stocknextt.com “Website” is general information only and it does not consider your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The Website is published by StockNextt a trade name under Kalkine Canada Advisory Services Inc. The link to our Terms and Conditions and Privacy Policy has been provided for your reference. On the date of publishing this article/report (mentioned on the website), employees and/or associates of StockNextt or Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the articles/ reports should not consider these stocks as advice or recommendations later.