Source: Shutterstock

Highlights

- CGI Inc. has reported 5.1% YoY revenue growth in Q1 2025, reaching CAD 3,785.2 million

- Net Income climbed 12.5% YoY, reaching CAD 438.5 million in Q1 2025

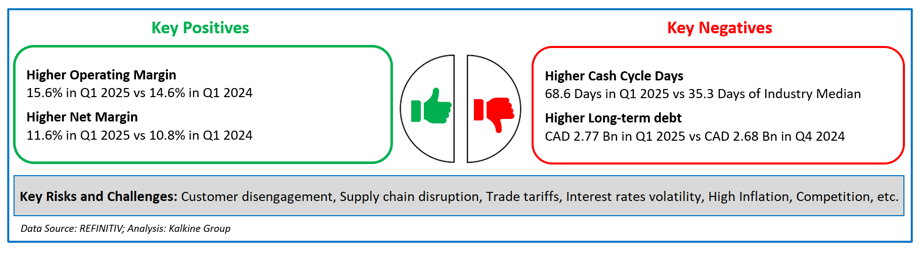

- Operating margin improved to 15.6%, net margin reached 11.6% in Q1 2025.

- CGI and Volkswagen deepened global collaboration and launched marv1n for digitalization projects.

CGI Inc. (TSX:GIB.A) is a Canada-based IT services provider, generating over CAD 12 billion revenue annually, with 76,000 employees across 400 offices in 40 countries throughout North America and Europe.

Q1 2025 financial performance

In the first quarter of 2025 (Q1 2025), CGI Inc. reported total revenue of CAD 3,785.2 million, a 5.1% YoY increase from Q1 2024's CAD 3,602.9 million. The growth was chiefly driven by recent business acquisitions and organic growth.

Operating expenses for the quarter rose to CAD 3,193.4 million, a 3.8% YoY increase from Q1 2024’s CAD 3,075.8 million. The rise was attributed to the temporary dilutive impact of recent acquisitions. However, as a percentage of revenue, selling and administrative costs decreased, thanks to savings from the cost optimization program.

Earnings before income taxes in Q1 reached CAD 591.7 million, up 12.3% YoY from CAD 527.1 million in Q1 2024. Overall, net income for the quarter was CAD 438.5 million, a 12.5% YoY increase from the previous year's CAD 389.7 million.

Additionally, the company cloaked a higher operating margin of 15.6% and a higher net margin of 11.6% during the quarter compared to 14.6% and 10.8%, respectively, compared to the prior corresponding period.

Recent Business Update

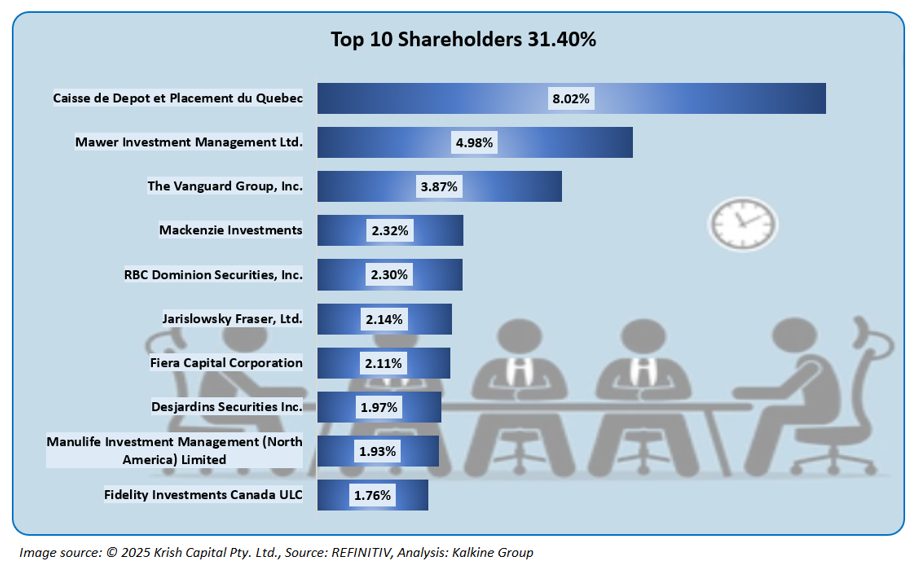

Top 10 Shareholders

The top 10 shareholders of CGI together own approximately 31.40% of the company's total shareholding. Among them, Caisse de Depot et Placement du Quebec and Mawer Investment Management Ltd. hold the largest stakes, with around 8.02% and 4.98% stakes, respectively.

Stock Information

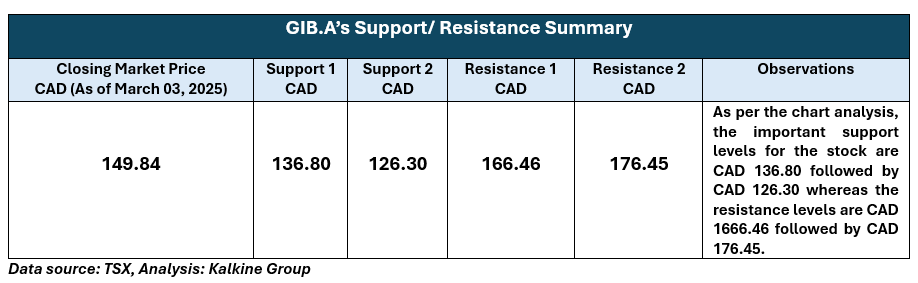

The stock price of CGI has declined by around 12.54% in the past month. However, it has gained around 11.30% in the past nine months. The stock’s 52-week low and high spans from CAD 132.00 to CAD 175.35. As of March 03, 2025, the stock’s closing price is CAD 149.84.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference data for all price data, currency, technical indicators, support, and resistance levels is March 03, 2025. The reference data in this report has been partly sourced from REFINITIV.

Technical Indicators Defined

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Disclaimer:

StockNextt having Ontario Business Identification Number 1000958347 and British Columbia registration Number FM1051529 is a trade name under Kalkine Canada Advisory Services Inc., having Business Number 761925130BC0001. The information provided on https://stocknextt.com “Website” is general information only and it does not consider your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The Website is published by StockNextt a trade name under Kalkine Canada Advisory Services Inc. The link to our Terms and Conditions and Privacy Policy has been provided for your reference. On the date of publishing this article/report (mentioned on the website), employees and/or associates of StockNextt or Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the articles/ reports should not consider these stocks as advice or recommendations later.